Corn and soybean prices have declined from historic highs in 2022 to long-run common ranges. (See: farmdoc every day May 31, 2022) After crop prices expert a similar decline between 2012 and 2014, grain farms inside the Corn Belt went by means of an extended interval of low or damaging web farm earnings. All through this period, many farms coated losses by drawing down working capital, belongings like cash or grain inventories which may be liquidated quickly to fulfill payments. The liquidity supplied by working capital permits farms proceed operations inside the face of losses, as an example, by allowing them buy inputs important to plant the next yr’s crop.

Wanting ahead, Faculty of Illinois farmdoc crop budgets for 2025 stage to damaging returns for corn and soybean farms. (See: farmdoc every day September 24, 2024) Must low returns persist, farmers may experience financial challenges similar to what they expert post-2014. Grain farms inside the US Corn Belt have constructed liquidity. Nonetheless, liquidity may differ extensively all through farms (See: farmdoc every day December 12, 2024). Notably, youthful farmers is also a lot much less liquid and on account of this reality additional uncovered to monetary downturns. Understanding the hyperlink between farm liquidity and enterprise effectivity is important to weathering the doable downturn inside the farm monetary system that lies ahead, notably if that downturn extends for a variety of years.

This analysis analyzes the affiliation between working capital constructed by farms as a lot as 2014 and farm enterprise effectivity in the middle of the following low-price years from 2015-2018. Using information from Illinois FBFM, we observe the similar farms over time. Whereas profitability per acre varies extensively all through farms in our information, there are some economically important variations in web farm incomes by baseline liquidity place. Extreme liquidity farms generally tend to achieve increased subsequent returns in troublesome cases, although there’s some proof that having very extreme liquidity ranges should not be associated to increased effectivity.

Liquidity on Illinois Grain Farms

This analysis considers a set of frequent farm financial metrics. Notably, we take a look on the subsequent:

- Liquidity measures how quickly a farm can meet its short-term obligations using its current belongings – points like cash and objects which may be supplied quickly. Liquidity is often measured by considering current belongings relative to current liabilities, so that liquidity could also be in distinction all through firms.

- Working capital per acre is a liquidity measure meant to be comparable all through farm firms. It is calculated as current belongings minus current liabilities, divided by the entire acres farmed. In simpler phrases, it is the excellence between what a farm owns and what it owes inside the fast time interval, normalized by farm measurement to permit comparability all through different-sized operations. This metric signifies sources obtainable to cowl day-to-day payments.

- Internet farm earnings (NFI) per acre represents the profitability of a farm relative to its measurement. It represents a return to operator’s labor and owned farmland. Higher NFI per acre signifies {{that a}} farm generates additional earnings from each acre it manages.

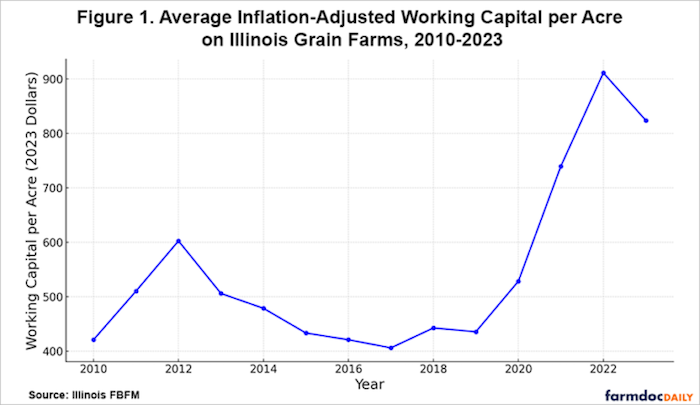

- We contend that the interval following 2014 provides needed lessons about managing the farm by means of altering market circumstances. Decide 1 reveals developments in inflation-adjusted widespread working capital per acre on Illinois grain farms. Working capital peaked in 2012 and 2022, years with extreme commodity prices. Even after adjusting for inflation, widespread working capital ranges in 2022 are significantly higher than seen inside the earlier development. After peaking in 2012, Illinois grain farms on widespread continually drew down working capital for the next 5 years. The 2015-2018 interval is the heart of this downturn, so our analysis models 2014 as a baseline and considers farm effectivity between 2015-2018.

Click on on to enlarge

The annual averages confirmed in Decide 1 characterize no specific particular person farm; specific particular person effectivity varies all through time and all through farms. Understanding how farms carried out after they realized a selected stage of liquidity, every extreme and low, reveals invaluable lessons about farm financial administration associated to the current downturn inside the farm monetary system Provide: Illinois FBFM

Preliminary Liquidity and Subsequent Profitability inside the Last Farm Monetary Downturn

Our analysis considers how preliminary liquidity ranges firstly of the ultimate farm monetary downturn have been associated to farm effectivity in subsequent years. We bear in mind Illinois grain farms who current usable financial data to Illinois FBFM for yearly from 2014 to 2018. This dataset contains 1,005 distinctive farms. We kind these farms by working capital per acre and divide them into 5 equal-sized lessons (very low, low, medium, extreme, and actually extreme). Frequent 2014 working capital per acre for this subset of farms was -$88, $172, $369, $604, and $1,333 for the very low, low, medium, extreme, and actually extreme lessons, respectively.

Decide 2 illustrates the evolution of farm effectivity by liquidity class over time. The decide reveals not solely typical or widespread profitability, nevertheless the distribution of web farm earnings all through farms. The boxplots current every the median web farm earnings per acre (the middle horizontal line in each colored bar) and the fluctuate of outcomes for farms in each liquidity class by yr. Fifty % of farms lie contained in the interquartile fluctuate given by the colored bars.

Dialogue

We uncover a relentless relationship between preliminary liquidity and subsequent farm effectivity over the past downturn inside the US farm monetary system from 2015-2018. The preliminary liquidity place of farms in 2014 was related to variations in web farm earnings that elevated over time. Extreme liquidity was associated to additional web farm earnings in 2015 and the gaps between very low, low, medium, and extreme liquidity farms grew in 2016, 2017, and notably 2018. This widening gap signifies that preliminary liquidity advantages may compound over time, as better-capitalized farms can every local weather adversity and seize funding alternate options that lower liquidity farms can’t. For example, higher liquidity farms may have the ability to make capital expenditures, purchasing for gear and land, when lower liquidity farms are struggling to cowl short-run manufacturing costs.

We do uncover some proof that additional liquidity should not be always increased. Farms inside the very extreme preliminary liquidity class tended to hold out equally to or worse than these inside the extreme class. In 2017 and 2018, median web farm earnings for the very extreme class was actually lower than for the extreme class. This means some farms may lack productive investments via which to deploy additional liquidity. Nonetheless, farms in the middle of the preliminary liquidity distribution demonstrated a relentless hierarchy, with medium liquidity farms sustaining a gradual profit over low-liquidity operations all via the interval. This pattern held by means of these tough years, suggesting that medium and extreme ranges of working capital supplied important benefits for operational stability.

Our findings have needed implications for farm financial administration as current forecasts counsel the next years may pose associated challenges for farm profitability as a result of the 2015-2018 interval. Our information signifies that sustaining ample working capital serves every defensive and offensive capabilities—defending operations all through downturns whereas enabling them to capitalize on alternate options as soon as they arrive up. As farmers face one different potential interval of market pressure, these historic patterns present invaluable lessons regarding the significance of developing and sustaining a robust liquidity place.

FBFM Info Acknowledgement

The authors acknowledge that information used on this analysis comes from the Illinois Farm Enterprise Farm Administration (FBFM) affiliation. With out FBFM, information as full and proper as this might not be obtainable for tutorial capabilities. FBFM, which consists of 5,000+ farmers and 70 expert space employees, is a not-for-profit group obtainable to all farm operators in Illinois. FBFM space employees current on-farm counsel along with recordkeeping, farm financial administration, enterprise entity planning and earnings tax administration. For additional information, please contact the FBFM office located on the campus of the Faculty of Illinois inside the Division of Agricultural and Shopper Economics at 217-333-8346 or go to the FBFM site at www.fbfm.org.

Click on on proper right here for additional Commerce Info.